What is LTV and how does is affect car loans

The acronym LTV stands for Loan to Value and is defined as follows.

- LTV

- The ratio of the Loan Amount divided by the Collateral Value

When it comes to getting

approved for a car loan this value is extremely important. Here at FundingWay.com we witness several times where car buyer was pre-approved online, but was unable to buy the car they wanted due to LTV restrictions set by the car loan lender. When you get pre-approved online the lender sets two conditions on the loan, a Maximum LTV amount, and a Maximum monthly payment amount.

How your credit score affects LTV

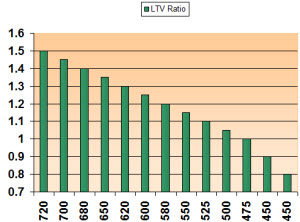

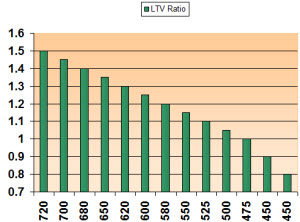

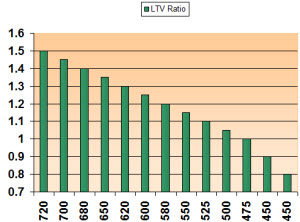

In most cases, the higher your credit score, the higher the maximum Loan to Value amount will be. These amounts will vary from lender to lender, but here are some guesstimations based on a vehicles wholesale for invoice value:

| Credit Score |

LTV Ratio |

| 720 |

1.50 |

| 700 |

1.45 |

| 680 |

1.40 |

| 650 |

1.35 |

| 620 |

1.30 |

| 600 |

1.25 |

| 580 |

1.20 |

| 550 |

1.15 |

| 525 |

1.10 |

| 500 |

1.05 |

| 475 |

1.00 |

| 450 |

.90 |

| Below 450 |

.80 |

Here's an example of how LTV would differ for two people, one with a 500 credit score and one with a 700 credit score. In this example the sales price of the car is $10,000 and the wholesale value of the car is $9,000.

| Item |

700 Credit Score |

500 Credit Score |

| Sales Price

| $10,000 |

| Plus Est. Tax, Title, & License Fees

| $750 |

| Total Out the Door Price

| $10,750 |

| |

| Wholesale Value

| $9,000 |

| Times Max LTV

| 1.45 |

1.05 |

Max Loan

| $13,050 |

$9,450 |

Cash Due at Signing

| 0 |

$1,300 |

In the example above, the person with a 700 credit score could basically sign and drive, whereas the car buyer with a 500 credit score would need $1,300 cash down to buy the $10,000 car. Loan to Value amounts will vary by creditor, but one thing is certain, the higher your credit score the more money you can borrow based on the values of the new or used car.

The acronym LTV stands for Loan to Value and is defined as follows.

When it comes to getting approved for a car loan this value is extremely important. Here at FundingWay.com we witness several times where car buyer was pre-approved online, but was unable to buy the car they wanted due to LTV restrictions set by the car loan lender. When you get pre-approved online the lender sets two conditions on the loan, a Maximum LTV amount, and a Maximum monthly payment amount.

The acronym LTV stands for Loan to Value and is defined as follows.

When it comes to getting approved for a car loan this value is extremely important. Here at FundingWay.com we witness several times where car buyer was pre-approved online, but was unable to buy the car they wanted due to LTV restrictions set by the car loan lender. When you get pre-approved online the lender sets two conditions on the loan, a Maximum LTV amount, and a Maximum monthly payment amount.  The acronym LTV stands for Loan to Value and is defined as follows.

The acronym LTV stands for Loan to Value and is defined as follows.